Archive for the ‘Executive Leadership’ Category

AEO — American Eagle — Update [01/10/10]

Well, I just noticed that today’s date is all ones and zeros. Not as momentous as the Armistice that ended World War I (the eleventh hour of the 11th day of the eleventh month), but, for a numbers geek, this is what suffices for entertainment.

My last posting on American Eagle (AEO) was on August 29 of 2008; although, I did include the stock as a current holding in the Bull series completed this week. Two acquaintances from one of the on-line forums made seperate assertions that prompted me to look at the stock and its performance more closely, and what I discovered was a surprise. Amazing, actually.

The first comment asserted that the stock market and the economy are in the toilet and will soon be at the solid waste disposal facility. The second questioned why the stock did not enjoy a boost in price with the most recent earnings announcement and higher guidance. The easy conclusion is that the first comment answers the second, even though they were not presented in the same thread on the message board (i.e., line of discussion). My take is dramatically different than either, but it is not dramatically different than prior assertions. In short, the market is more than inefficient, it gets some stocks badly wrong over protracted periods.

Of course, you might expect that I would take this position, since I am long (own the stock). Indeed, recent research into human psychology notes the difficulty we have admitting mistakes and reversing our prior positions; especially, those taken publicly. Given this, allow me to repost my response from that message board but, unlike the original, provide the charts and graphs in support and a small number of additional comments (based on the ability to post the graphs and charts).

Question: “Why is AEO trading down? I thought these results would cause AEO to [go to] at least go to $20. Yet it’s under $17. What am i missing?”

Response:

Why? Good question.

The current PE is 25.36. This puts AEO above 73.93% of all stocks current trading (the non-financial firms). Consensus for next year is $0.32 per share in earnings, which equates to a PE of 54.25, and that is above 99.50% of all stocks currently trading. (Percentages based on regression-fitted gamma distributions.)

On the other hand, AEO is currently selling at a price to net asset value of 2.37, which puts it among the cheapest 5.42% of the market (just 1.68 times replication value — $17.36 (current price) divided by $10.32 (Replication Value).

So, the stock appears to be overvalued based on earnings, while it is undervalued based on assets. The reason for the difference (I suspect) is the uncertainty over of the consumer, for all the reasons my pessimistic friend mention.

It may be helpful to recall that the company guided above performance just prior to the market crash, with expansion plans into two new demographics and sales overseas, with sustained growth of 12%-to-14%.

Now, it is important consider the limitations associated with basing valuations on earnings. This is why Buffett looks at Owners Earnings, rather than GAAP earnings. GAAP earnings include such non-cash items as depreciation, amortization, and changes to “Goodwill.”

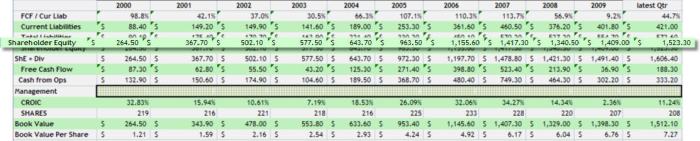

For me, the bigger measure of management success is shareholders equity growth, since this more accurately measures the value of a company today. Shareholders equity is calculated as total assets minus total liabilities.

To FULLY assess AEO’s shareholders equity, look at the percentages of free cash flows and owners earnings converted to shareholders equity.

The five year average is around 80%. This would have been higher if not for significant funds invested in upgrading operations in 2008 and 2009 (around $278 million in 2009, alone).

So, while some have complained about the company’s expenditures on growth, estimated maintenance CapEx appears to have dwarfed growth CapEx in 2007 and 2008 ($203 million and $278 million versus $84 million and $0 million), leading to $94 million and $105 million spent on maintenance CapEx above declared depreciation levels.

This is important because it informs free cash flows retained as shareholders equity and cash flows used to repurchase shares. CapEx represents the company’s investment in the future, while shareholders equity is the value of the company to which I (and you) are part owners.

So, has the company been investing in the future to our detriment? Well, before the crash, shareholders equity was $1.155 billion in 2006 and grew to $1.417 billion in 2007 (a 23% increase). It dropped to $1.340 billion in 2008 (the crash), rebounded to $1.409 billion in 2009, and is currently at $1.523 billion. This actually represents a 7% improvement over pre-crash levels, despite its CapEx expenditures.

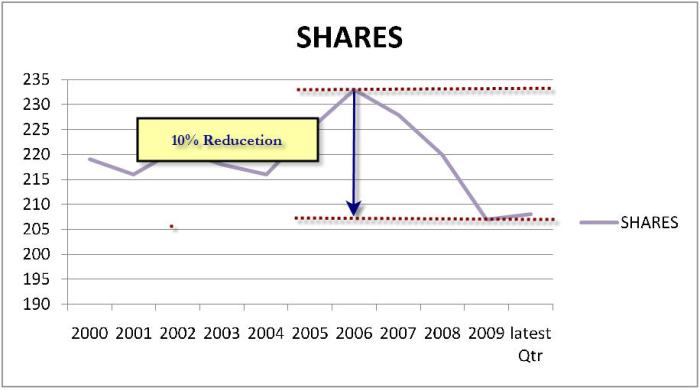

That, however, doesn’t tell the full story, either. The company has bought back shares (from 233 million in 2006 to 208 million currently — just under 11%).

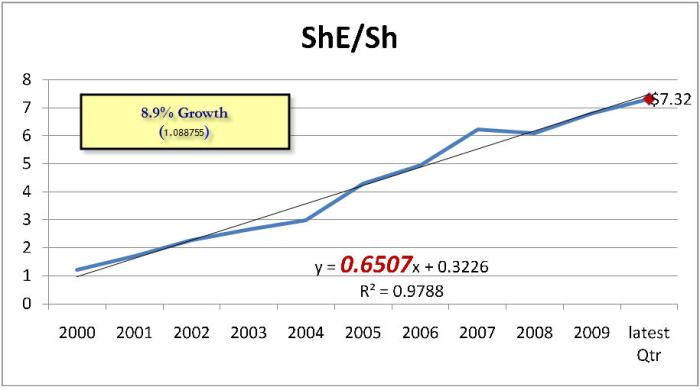

This is important because it alters the per share value of shareholders equity. It was $4.96 in 2006 and currently stands at $7.33.

That is a 10.26% compounded annual growth rate —

That is the result for those who have held the stock over the last several years. Going forward?

This chart (above) provides the shareholders equity per share results with a trendline, a measure of the trend’s accuracy, and the equation for that trendline. At R-Squared 0.9788, the line is pretty close to a perfect 1.0 (just 0.006 variance). The bolded red figure is the slope (recall from school the equation for a line — Y = MX + B –, where M is the slope). So, AEO is adding $0.65 to the per share value of shareholders equity, and this equates to 8.9% growth for the coming year if the trend continues. That is more than double the rate generated by the 10-year US Government bond.

So, the company invested in growth, invested in current operations, bought back shares, absorbed losses due to auction rate securities, kept its current ratio at 2.60, maintained its total debt ratio at 0.27%, ***AND*** grew shareholders equity per share at more than 10% during the worst economic crash since the Great Depression.

Impressed? If not, you never attended business school or didn’t pay attention while there.

So, did Wall Street get it wrong when not rewarding the company for better than expected earnings and forward guidance? I don’t know, but all of this does suggest they have been pretty clueless for the last three years.

Recall that Warren Buffett has maintained that the great lesson of Charlie Munger is a willingness to pay a fair price for a company possessing excellent management. If needing evidence that American Eagle possesses excellent executive leadership, this posting should prove the point.

If not satisfied, the burden of proof is entirely yours.

Investing and Healthcare — The Quality and Learning Link

A couple of years ago, my colleague Jim Porto at UNC Chapel Hill asked me to teach a two-day seminar on performance psychology, and I loved it. My students, on the other hand, initially evidenced a normal distribution, with agnosticism as the mean. In other words, a small number loved it, a small number hated it, and most figured it was a necessary block to check before moving on to more productive things. As I continued to teach it and my skills presenting the materials became better, the response improved, and, because the materials were taken from research rather than the self-help section at Borders, the impact has been rewarding (and the student evaluations would make my mother proud).

Well, I no longer teach the seminar (having handed it to others who are every bit as capable), but I’ve retained interest in the topic. Over the winter holidays, I read Malcolm Gladwell’s Outliers and Geoff Colvin’s Talent is Overrated. While both are interesting (Colvin’s is better, despite Gladwell’s higher standing on the New York Times Best Seller list), I decided to apply Jacobi and invert – looking at the causes of failure.

Update on the Market and Other Musings — 10/18/08

It has been two weeks since my last update on this blog. Since then, the market has undergone gyrations that are unprecedented. While I can’t imagine that anyone is following this blog closely enough to mirror my investments, doing so would have significantly outperformed the S&P 500 – even in this dramatic environment. Since the market highs of October 2007, my portfolio is down 12.43% versus the S&P 500s decline of just under 40%. This is largely due to the recommended short position (of the S&P 500), but the long positions in my portfolio have strongly contributed to these favorable results, as well. Even during a market crash, owning value stocks is its own reward.

With this update, I would like to address several new items at this point in the market’s life. Longer than most postings, it looks at the current investing environment, considers international opportunities (first-world and emerging-market), addresses the Bretton Woods II proposal, considers the regulatory pedullum shift, provides a loose model for identifying winning and losing markets in the future, and ends with a non-partisan plea for political change in the US.

Cash Return on Invested Capital and Weighted Average Cost of Capital Calculations

Over the last several weeks, I’ve been asked about my calculations for Weighted Average Cost of Capital (WACC) and Cash Return on Invested Capital. At some point, I’ll run through the specific calculations and logic behind them. Until then, allow me to provide the calculations which appear on the spreadsheet used for equities analysis postings.

CQI In Complex Industries

The distinction between Total Quality Management and Continuous Quality Improvement is that CQI has been modified for healthcare environments. While earlier postings discuss the success of TQM on the factory floor and in production operations, it may be helpful to contrast that side of industry with something more akin to healthcare, such as information technology (especially, software design and development).

Reversion To The Mean

The question had to do with “Reversion to the Mean” in investment settings, but, in fact, it extends to management of firms, in general. Simply put, it sought a defense of reversion to the mean as a reliable and actionable model. The answer, in my view, requires an understanding of physics, psychology, philosophy, economics, and management. Here is the original question and my response.

Like a Hamster on a Wheel — Time Management Versus Innovation

Reference: High School’s Worst Year?; For Ambitious Teens, 11th Grade Becomes a Marathon Of Tests, Stress and Sleepless Nights. Jonathan Kaufman. Wall Street Journal. (Eastern edition). New York, N.Y.: May 24, 2008. pg. A.1

I often wonder whether the “Life-Long Learner” is a conceptual myth. It isn’t that we can avoid intellectual growth as we age – it is all but compelled by the speed of change. Nor is it sustaining the love of learning that has me uncertain about whether the life-long learner remains viable. Instead, as the father of a high school junior, a teacher of undergraduates and graduate students, and as a consultant working with physicians, I see the problems from several informing perspectives.

Balance Billing — Grief for Everyone

The practice of balance billing is increasing, according to this Los Angeles Times article.

Balanced billing is defined as “billing beneficiaries for amounts not reimbursed by payers (not including copayments and coinsurance amounts); this practice is prohibited by Medicare regulations,” according to “Understanding Health Insurance: a Guide to Billing and Reimbursement”, ninth edition, by Michelle Green and JoAnn Rowell.

Computer Simulation Lessons Learned

In previous postings, the names Kahneman and Smith have been referenced – Daniel and Vernon, respectively. Jointly, they won the Nobel Prize in economics (2002); although, their work was conducted separately. http://nobelprize.org/nobel_prizes/economics/laureates/2002/index.html .

In the case of Kanneman, the award was “for having integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty,” and for Smith “for having established laboratory experiments as a tool in empirical economic analysis, especially in the study of alternative market mechanisms.”

Both focused on investor psychology and the use of simulations to study investor and market behavior, response to new information, reactions to uncertainty, and the speed with which markets achieve equilibrium.

I mention this because the use of simulations may strike some as fundamentally different than fully competitive markets, but the research was validated as accurately mirroring typical market responses under an assortment of scenarios.

Why mention it here? Well, I use a computer simulation with my marketing class, and, yesterday, the four competing teams gave their end-of-semester “lessons learned” presentations. As usual, the results were interesting, and I thought you might be interested in some of the more significant realizations.

The Strategic Helix of CQI — Sherika Hill

As time permits, I am posting final exam papers written by selected students of mine (with their consent, of course). In each case, they have addressed the question of whether the tools and techniques of continuous quality improvement work in healthcare settings. This seemingly simple question is abundantly difficult. My students, however, are brilliant, and I am frequently rewarded with “mind candy” such as that provided by Sherika Hill, who posits that the continuous improvement of Shewhart’s and Deming’s PDCA cycle is not necessitated by perfection’s impossibility but, instead, by the changing forces and influences of the informing environment.