Archive for January 2009

Danniyal is witnessing history

This title appeared as the Facebook status of my friend Danniyal — a first generation arrival from Pakistan. In grammar school, he became my son’s best friend, and, through that introduction, our families became exceedingly close. Today, he is a senior in high school, possessing a stratospheric GPA and a mind that amazes and delights the old fart who taught him algebra over a distant summer. During the election campaign, too young to vote, he volunteered for Barack Obama and, as occasionally happens with nacient campaigns, managed several events for the candidate. Today, amidst applications to college, Danniyal is interested in a career in public service, and, seeing his Facebook status, I sent him the following message:

Sears (SHLD) Real Estate Value Update — 1/14/09

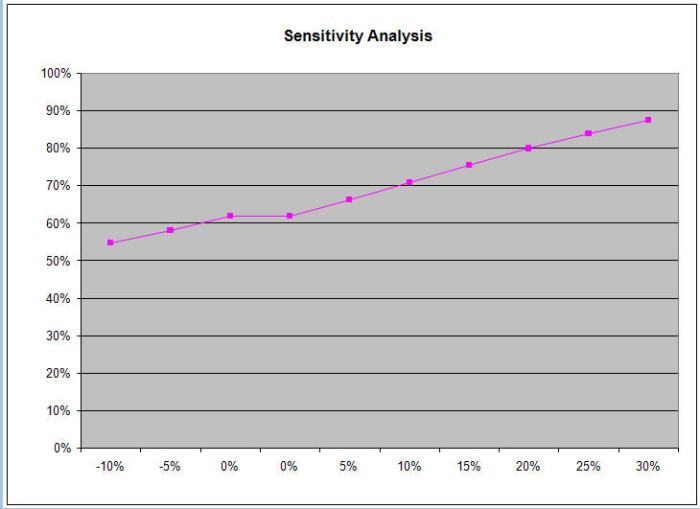

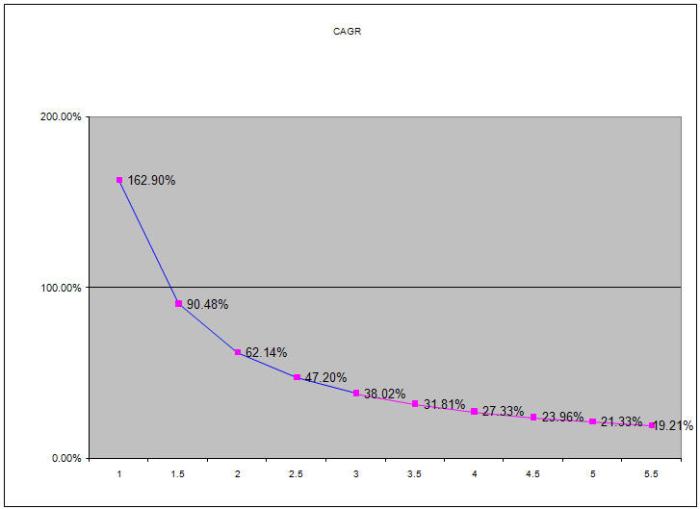

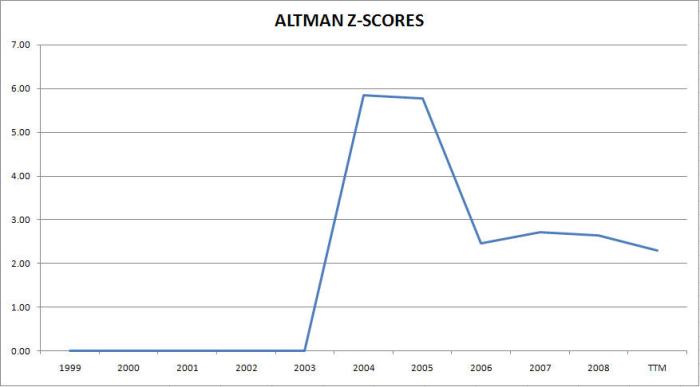

Last year, CS estimated the real estate value of SHLD at $4+ billion (4x listed book for these assets). This struck me as unlikely (and I’m long the stock). Besides than the name and credibility of Credit Swisse, there was little to support the assertion in the reporting of that figure by the Wall Street Journal. So, I cut that figure in half and came up with a value of $104 per share (at that time). Since then, the market has tanked, retail has suffered (and continues to do so), and retail real estate is suspect and worsening (a comfort for shorts, a worry for longs, and a problem that increases the uncertainties for both). Well, I just came across a more in-depth analysis of the real estate value that provides the assumptions and valuations at various prices per square foot, and, at $25/sq ft, the $2 billion estimate seems reasonable, even if marginally conservative.

Here is the reference: http://www.manualofideas.com/files/shld_moi_20081223.pdf

Investing and Healthcare — The Quality and Learning Link

A couple of years ago, my colleague Jim Porto at UNC Chapel Hill asked me to teach a two-day seminar on performance psychology, and I loved it. My students, on the other hand, initially evidenced a normal distribution, with agnosticism as the mean. In other words, a small number loved it, a small number hated it, and most figured it was a necessary block to check before moving on to more productive things. As I continued to teach it and my skills presenting the materials became better, the response improved, and, because the materials were taken from research rather than the self-help section at Borders, the impact has been rewarding (and the student evaluations would make my mother proud).

Well, I no longer teach the seminar (having handed it to others who are every bit as capable), but I’ve retained interest in the topic. Over the winter holidays, I read Malcolm Gladwell’s Outliers and Geoff Colvin’s Talent is Overrated. While both are interesting (Colvin’s is better, despite Gladwell’s higher standing on the New York Times Best Seller list), I decided to apply Jacobi and invert – looking at the causes of failure.

Housing Market Projections

Recently, my friend Dave posted a link to as full an analysis of the current housing market as I’ve seen. It isn’t pretty and may require anti-emetics to read. Here is the link:

http://www.designs.valueinvestorinsight.com/bonus/pdf/T2_Housing_Analysis.pdf

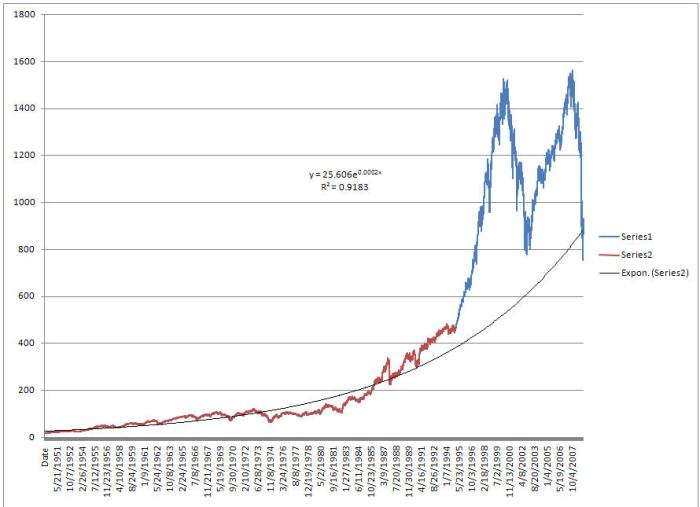

S&P 500 Trend Chart

Just a quick note on the S&P500 levels on this first day of 2009. The best fit regression trend line, using the data from 1950 through January 1 of 1995 (before the run up to the high tech bubble) provides a feel for the degree to which the market is over or undervalued.