Archive for May 2009

Sometimes You’re The Windshield …

Well, I’ve been true to my word on the investing front. It has been some time since my last posting, and, at that time, I wrote that I planned to wait for the market to regain some measure of sanity, as measured by a VIX below 30. Prior to that, I reassessed my portfolio, insuring I was comfortable holding each regardless of the market’s crisis. Since then, I’ve made no changes and avoided the urge to post. The effect has been to lose just 2 percent of my portofolio’s value — down just under 20 percent at the market’s worst, when the market was down roughly 50 percent. With the market up from its recent lows, I fully expect that we will retest the lows, but it is time to start looking for values again … humbled, certainly, … . So, stay tuned.

Some times you’re the windshield … Sometimes you’re the bug.

________________

SC,

Thank you for the question on healthcare stocks. Since most of our correspondence has surrounded UNH, I should note that I have not sold a single share in that position. Ditto with TEVA, FRX, and quasi-health-stocks JNJ and PG. Sometime back, I did take a speculative position in SLP and have been aggressively acquiring MCK (which is now the largest single holding in my portfolio). Since the market highs last August, my healthcare holdings are up 8 percent in equity value appreciation (before taking dividends into account). By comparison, the S&P is down 30 percent and the index of S&P healthcare stocks is down 18 percent.

This (above) shows current holdings and the percentage paper gain/loss before dividends. It does not show realized gains and losses, which add a further 5.577 percent to the total.

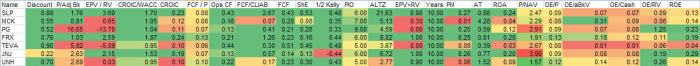

More importantly, the question you ask is more germane to the dilemma confronting investors today — are any of these worth considering now. Here is my summary-analysis sheet for each of the stocks mentioned above:

Discount is the percent below estimated DCF value (using FCF growth rates for the prior decade), 1/2 Kelly should be ignored, PM and AT represent profit margin and asset turns, EPV and RV are earnings power value and replication value, CLIAB is current liabilities, ALTZ is Altman Z, and OE is owner’s earnings. Note that PG is selling at an exceedingly high price to adjusted book, TEVA’s ROE is low, and MCK’s profit margin (PM) hasn’t caught up with the latest results. JNJ’s DCF discount is roughly at the same value as when Buffett began acquiring. Otherwise, each is worthy of holding and all are worth considering as new investments if basing the decision only on prior results. [Note: I’m not touting any, specifically, because you didn’t ask, and, until your note, I’d been pretty successful exiting this side of the blog. The graphic is provided just to indicate that, for my personal holdings, I still perform the analysis earlier postings documented.]

As for my strategic view of the health market place, there is considerable uncertainty with the administration’s efforts. Those efforts have not costed-out favorably by the Congressional Budget Office (as predicted when we — you and I — first considered this issue), and, within recent weeks, opposition efforts have gained traction (those opposing “reform” as a progression toward a single payer or socialized medicine system). I believe both sides are wrong on too many fronts to recount here, but, in general, the status quo is unsustainable and no proposed reform will deliver the desired results. Eventually, we seem destined to move away from a free market system (having dawdled during the decades when meaningful intervention might have made a difference). The electorate, however, has not recognized this (nor have our political leaders of either party). So, I suspect the health insurance industry will survive as current efforts at reform, either, fail or some element of free market healthcare is retained in any legislative compromise. In other words, the dawdling seems likely to continue.

The bigger issue for the investor is positioning. While I bought UNH on the way down and have marginally benefited as the price has recovered somewhat (it was down as much 70 percent at one point), it remains one holding in a portfolio that is diversified across sectors and within healthcare. If it goes to zero, I’ll still be up on the sector. Note, however, that latest results indicate weighted average cost of capital marginally exceeds cash return on invested capital, even as the company exceeds an Altman-Z bankruptcy gray-zone risk of 1.81 (current assets cover 317 days of operating costs — not shown above). Moreover, the other stocks in the healthcare sector have no exposure to health insurance. JNJ and PG are internally diversified. MCK is internally diversified, even though it is largely viewed as pharma-distribution play. FRX and TEVA produce generics, and SLP is a pharma-research/IT play. So, while I have not sold UNH, I’m not adding, either.

SC, I hope this helps, and my apologies for the delay responding. I’m preparing for the coming school year and have been working to meet publication deadlines for a seminar text.